A) Debit Cash of $180 and credit Sales $180.

B) Debit Cash of $180 and credit Accounts Receivable-Regional $180.

C) Debit Accounts Receivable-Regional $172.80;debit Credit Card Expense $7.20 and credit Sales $180.

D) Debit Cash $172.80;debit Credit Card Expense $7.20 and credit Sales $180.

E) Debit Cash $172.80 and credit Sales $172.80.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasper makes a $25,000,90-day,7% cash loan to Clayborn Co.Jasper's entry to record the transaction should be:

A) Debit Notes Receivable for $25,000;credit Cash $25,000.

B) Debit Accounts Receivable $25,000;credit Notes Receivable $25,000.

C) Debit Cash $25,000;credit Notes Receivable for $25,000.

D) Debit Notes Payable $25,000;credit Accounts Payable $25,000.

E) Debit Notes Receivable $25,000;credit Sales $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The person who signs a note receivable and promises to pay the principal and interest is the:

A) Maker.

B) Payee.

C) Holder.

D) Receiver.

E) Owner.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasper makes a $25,000,90-day,7% cash loan to Clayborn Co.The amount of interest that Jasper will collect on the loan is:

A) $1,750.

B) $145.83.

C) $437.50.

D) $19.44.

E) $875.00.

Correct Answer

verified

Correct Answer

verified

Essay

A ____________________ is a signed agreement to pay a specified amount of money either on demand or at a definite future date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount due on the maturity date of a $6,000,60-day 4%,note receivable is:

A) $6,000.

B) $6,240.

C) $5,760.

D) $6,040.

E) $5,960.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

MacKenzie Company sold $180 of merchandise to a customer who used a Regional Bank credit card.Regional Bank deducts a 4% service charge for sales on its credit cards.MacKenzie electronically remits the credit card sales receipts to the credit card company and receives payment in approximately 5 days.The journal entry to record the collection from the credit card company would be:

A) Debit Cash of $172.80 and credit Accounts Receivable-Regional $172.80.

B) Debit Cash of $180;credit Credit Card Expense $7.20 and credit Accounts Receivable $172.80.

C) Debit Accounts Receivable-Regional $172.80;debit Credit Card Expense $7.20 and credit Sales $180.

D) Debit Cash $172.80;debit Credit Card Expense $7.20 and credit Sales $180.

E) Debit Cash $172.80 and credit Sales $172.80.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company borrowed $10,000 by signing a 180-day promissory note at 9%.The total interest due on the maturity date is.

A) $900

B) $75

C) $450

D) $300

E) $1,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true regarding a credit card expense?

A) Credit card expense may be classified as a "discount" deducted from sales to get net sales.

B) Credit card expense may be classified as a selling expense.

C) Credit card expense may be classified as an administrative expense.

D) Credit card expense is not recorded by the seller.

E) Credit card expense is a fee the seller pays for services provided by the card company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

MacKenzie Company sold $300 of merchandise to a customer who used a Regional Bank credit card.Regional Bank deducts a 1.5% service charge for sales on its credit cards and credits MacKenzie's account immediately when sales are made.The journal entry to record this sale transaction would be:

A) Debit Cash of $300 and credit Sales $300.

B) Debit Cash of $300 and credit Accounts Receivable $300.

C) Debit Accounts Receivable $300 and credit Sales $300.

D) Debit Cash $295.50;debit Credit Card Expense $4.50 and credit Sales $300.

E) Debit Cash $295.50 and credit Sales $295.50.

Correct Answer

verified

Correct Answer

verified

Essay

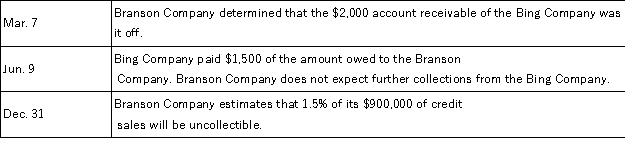

The Branson Company uses the percent of sales method of accounting for uncollectible accounts receivable.During the current year,the following transactions occurred:  Prepare the general journal entries to record these transactions.

Prepare the general journal entries to record these transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valley Spa purchased $7,800 in plumbing components from Tubman Co.Valley Spa Studios signed a 60-day,10% promissory note for $7,800.If the note is dishonored,what is the journal entry to record the dishonored note?

A) Debit Accounts Receivable $7,930;debit Bad Debt Expense $130;credit Notes Receivable $7,800.

B) Debit Bad Debt Expense $7,930;credit Accounts Receivable $7,930.

C) Debit Bad Debt Expense $7,800;credit Notes Receivable $7,800.

D) Debit Accounts Receivable-Valley Spa $7,800;credit Notes Receivable $7,800.

E) Debit Accounts Receivable-Valley Spa $7,930,credit Interest Revenue $130;credit Notes Receivable $7,800.

Correct Answer

verified

Correct Answer

verified

Essay

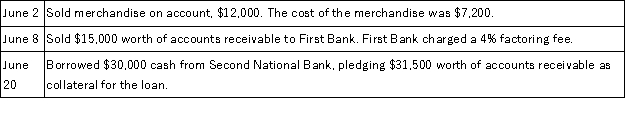

On May 31,a company had a balance in its accounts receivable of $103,200.Prepare journal entries to record the following transactions for June.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The materiality constraint,as applied to bad debts:

A) Permits the use of the direct write-off method when bad debts expenses are relatively small.

B) Requires use of the allowance method for bad debts.

C) Requires use of the direct write-off method.

D) Requires that bad debts not be written off.

E) Requires that expenses be reported in the same period as the sales they helped produce.

Correct Answer

verified

Correct Answer

verified

Essay

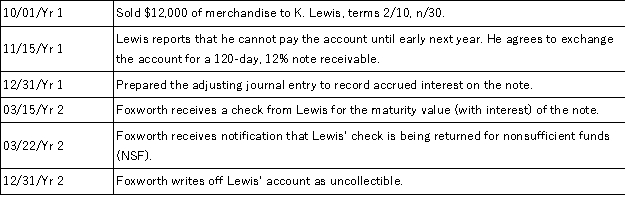

The following series of transactions occurred during Year 1 and Year 2,when Foxworth Co.sold merchandise to Kevin Lewis.Foxworth's annual accounting period ends on December 31.  Prepare Foxworth Co.'s journal entries to record the above transactions.The company uses the allowance method to account for its bad debt expense.

Prepare Foxworth Co.'s journal entries to record the above transactions.The company uses the allowance method to account for its bad debt expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements regarding recognition of receivables under U.S.GAAP and IFRS are true except:

A) U.S.GAAP and IFRS have similar asset criteria that apply to recognition of receivables.

B) Receivables that arise from revenue-generating activities are subject to broadly similar criteria for U.S.GAAP and IFRS.

C) The realization principle under GAAP implies an arm's length transaction occurs.

D) GAAP refers to the earnings process and IFRS refers to risk transfer and ownership reward.

E) Differences arise mainly from industry-specific guidance under U.S.GAAP.

Correct Answer

verified

Correct Answer

verified

Essay

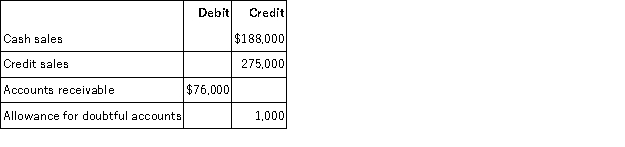

A company had the following items and amounts in its unadjusted trial balance as of December 31 of the current year:  Prepare the adjusting entry to estimate bad debts assuming an aging analysis estimates that 8% of the outstanding accounts receivable will be uncollectible.

Prepare the adjusting entry to estimate bad debts assuming an aging analysis estimates that 8% of the outstanding accounts receivable will be uncollectible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has $90,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts.Experience suggests that 4% of outstanding receivables are uncollectible.The current balance (before adjustments) in the allowance for doubtful accounts is an $800 debit.The journal entry to record the adjustment to the allowance account includes a debit to Bad Debts Expense for:

A) $3,600

B) $3,568

C) $3,632

D) $2,800

E) $4,400

Correct Answer

verified

Correct Answer

verified

Essay

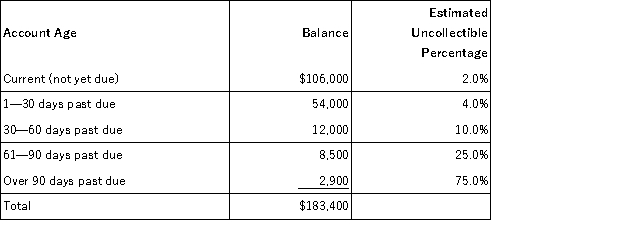

A company has the following unadjusted account balances at December 31,of the current year;Accounts Receivable of $183,400 and Allowance for Doubtful Accounts of $1,600 (credit balance).The company uses the aging of accounts receivable to estimate its bad debts.The following aging schedule reflects its accounts receivable at the current year-end:  Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31,of the current year,balance sheet.

Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31,of the current year,balance sheet.

Correct Answer

verified

Correct Answer

verified

Essay

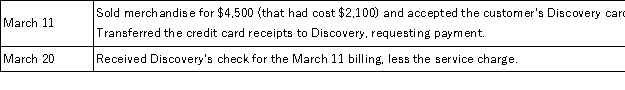

Mercks accepts the Discovery credit card for credit card sales.Mercks sends credit card receipts to Discovery on a weekly basis.Discovery charges Mercks a 3% fee.Mercks usually receives payment from Discovery within a week.Prepare journal entries to record the following transactions.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 117

Related Exams