A) startup costs.

B) patents.

C) copyrights.

D) inventories.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows that investors either provide to or receive from the business are called cash flows from owners' equity.

Correct Answer

verified

Correct Answer

verified

Essay

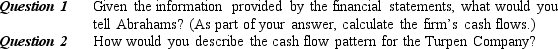

You Make the Call-Situation 2

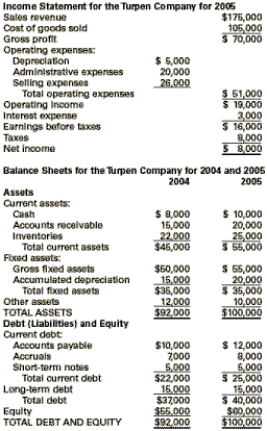

At the beginning of 2005, Mary Abrahams purchased a small business, the Turpen Company, whose income statement and balance sheets are shown below.

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

Correct Answer

verified

Thus, the Turpen Company generated $6,0...

Thus, the Turpen Company generated $6,0...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

The debt ratio is determined by dividing the firm's total debt by the total _____.

A) income

B) operating profits

C) assets

D) liabilities

Correct Answer

verified

Correct Answer

verified

True/False

The major difference between cash-basis accounting and accrual-basis accounting lies in when the firm recognizes revenue and profits.

Correct Answer

verified

Correct Answer

verified

True/False

To determine the debt ratio, the total debt is divided by the total assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As Krista explained to her daughters Ashley and Cameron, the report that provides a picture of the firm's assets and its sources of financing at a point in time is the

A) balance sheet.

B) income statement.

C) cash flow statement.

D) asset list.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business loan for 9 months would be best described as a(n)

A) account payable.

B) accrued expense.

C) short-term note.

D) long-tern debt.

Correct Answer

verified

Correct Answer

verified

True/False

The best financial ratio to determine a company's ability to pay debt as it comes due is the debt ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example of a current asset is

A) equipment.

B) land.

C) leased property.

D) accounts receivable.

Correct Answer

verified

Correct Answer

verified

True/False

The net income does not measure the return on the firm's total assets.

Correct Answer

verified

Correct Answer

verified

True/False

In order to determine the cash flows from day-to-day operations the firm must convert the company's income statement from an accrual basis to a cash basis.

Correct Answer

verified

Correct Answer

verified

True/False

The income statement shows a firm's financial position on a specific date.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The _____ shows all cash receipts and payments involved in operating the business and managing its financial activities.

A) income statement

B) balance sheet

C) cash flow statement

D) statement of financial position

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current assets include all of the following EXCEPT

A) accounts payable.

B) accounts receivable.

C) cash.

D) inventories.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of a depreciable asset

A) is constant over time.

B) increases with each use of the asset.

C) decreases over time.

D) increases over time.

Correct Answer

verified

Correct Answer

verified

Essay

List the four primary ways an entrepreneur's decisions play out when it comes to evaluating a firm's financial performance.

Correct Answer

verified

1. The firm's ability to pay its debt wh...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Jan Woodring is considering investing in a business. To see the firm's financial position over a period of time, she should look at its balance sheet.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 78 of 78

Related Exams