B) False

Correct Answer

verified

Correct Answer

verified

True/False

Money is anything that generally is accepted as a medium of exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the most widely followed short-term interest rate?

A) the federal funds rate

B) the three-month Treasury bill rate

C) the commercial paper rate

D) the government bond rate

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following causes the quantity of money demanded to increase?

A) an increase in nominal income

B) a decrease in nominal income

C) a decrease in the price level

D) a decrease in the interest rate

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A currency that is not backed by gold, silver, or any other precious commodity equal to the face value of the money is known as

A) fake money.

B) weak money.

C) token money.

D) commodity money.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in the discount rate will most likely

A) decrease the money supply.

B) not effect the money supply.

C) increase the money supply.

D) have an unclear affect on the money supply.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Banks are legally required to hold a percentage of all deposits as reserves.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury bills are government securities that

A) mature in more than five years.

B) have an infinite maturity date.

C) mature in less than one year.

D) have no maturity date.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Things that a firm owns that have ________ are classified as assets.

A) worth

B) no value

C) negative value

D) any of the above

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

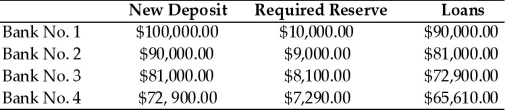

Refer to the information provided in Scenario 25.2 below to answer the question(s) that follow.

SCENARIO 25.2: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up.  -Refer to Scenario 25.2. If the required reserve ratio were changed to 20%, total loans of Bank No. 2 will change to

-Refer to Scenario 25.2. If the required reserve ratio were changed to 20%, total loans of Bank No. 2 will change to

A) $64,000.

B) $72,000.

C) $74,250.

D) $80,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bank of Roseland has $700 million in deposits. The required reserve ratio is 15%. Bank of Roseland must keep ________ in reserves.

A) $55 million

B) $85 million

C) $105 million

D) $140 million

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand for money and the interest rate are

A) positively related.

B) negatively related.

C) sometimes positively related and other times negatively related, depending on the condition of the economy.

D) not related.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bank of Red Oak has $2 million in deposits and $400,000 in reserves. If excess reserves are equal to $100,000, the required reserve ratio is

A) 5%.

B) 10%.

C) 15%.

D) 20%.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the required reserve ratio

A) will increase the money supply.

B) will decrease the money supply.

C) will not change the money supply.

D) will decrease the discount rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Close substitutes for transactions money are known as

A) fiat monies.

B) near monies.

C) commodity monies.

D) token monies.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Along with currency not in banks and deposits in checking accounts, what is another component of the M1 measure of money?

A) credit cards

B) debit cards

C) traveler's checks

D) prepaid accounts

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Argon Bank has $8 million in deposits and $1,600,000 in reserves. If the required reserve ratio is 20%, excess reserves are equal to

A) zero.

B) $80,000.

C) $320,000.

D) $640,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The money multiplier is calculated as (1 ÷ required reserve ratio).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The members of the Board of Governors of the Fed make up a majority of the Federal Open Market Committee.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in M2, but not included in M1?

A) currency held outside banks

B) travelers checks

C) demand deposits

D) savings accounts

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 357

Related Exams