A) An emissions tax is a more efficient way to reduce pollution than is an environmental standard because an emissions tax equalizes the marginal benefit of pollution from all sources.

B) An environmental standard is a more efficient way to reduce pollution than is an emissions tax because an environmental standard can be structured to equalize the reduction in pollution from all sources.

C) If an emissions tax and environmental standards lead to the same total reduction in pollution,then they will also lead to the same reduction in pollution by individual polluters.

D) It is easy to set emissions taxes at the "correct" level since the relationship between emissions taxes and the reduction in emissions that they induce has been extensively studied and is well known.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the number of available tradable emissions permits is decreased,the equilibrium price of the permits _____ and the equilibrium quantity of emissions _____.

A) decreases;decreases

B) increases;increases

C) increases;decreases

D) decreases;increases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

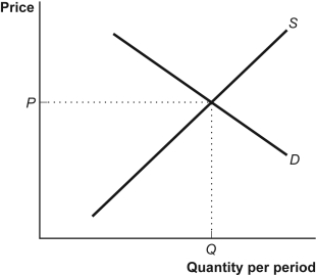

Use the following to answer question:

Figure: Model of a Competitive Market  -(Figure: Model of a Competitive Market) Use Figure: Model of a Competitive Market.Given the figure,if a tax is imposed on sellers,the equilibrium price will _____ and the equilibrium quantity will _____.

-(Figure: Model of a Competitive Market) Use Figure: Model of a Competitive Market.Given the figure,if a tax is imposed on sellers,the equilibrium price will _____ and the equilibrium quantity will _____.

A) increase;decrease

B) remain the same;increase

C) remain the same;decrease

D) increase;increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which example BEST describes tradable emissions permits?

A) a tax system for internalizing emission costs to the market

B) a subsidy system for encouraging production of goods with positive externalities

C) a system of voluntary negotiations between polluters and damaged parties

D) a system of licenses that can be bought and sold and that enable the holder to pollute up to a specified amount during a given period

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An example that does NOT illustrate an external cost is:

A) the smoke nuisance of a factory.

B) zoning restrictions on your property.

C) land defilement from strip mining.

D) a spreading patch of weeds on your next-door neighbor's lawn.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pigouvian taxes:

A) tax the profits of polluting firms.

B) are designed to reduce external costs.

C) are essentially the same as emissions standards.

D) are tradable emissions permits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which example is a good or market activity that is associated with a positive externality?

A) smoking cigarettes

B) listening to a new CD with earbuds

C) innovation in the semiconductor industry

D) an indoor classical music concert with tickets that cost $50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

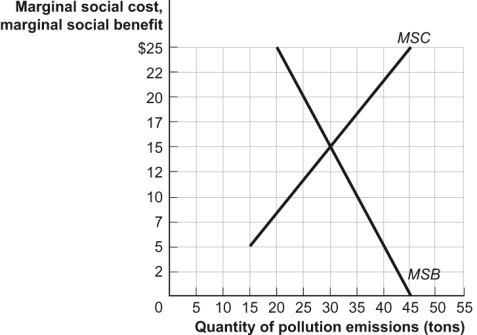

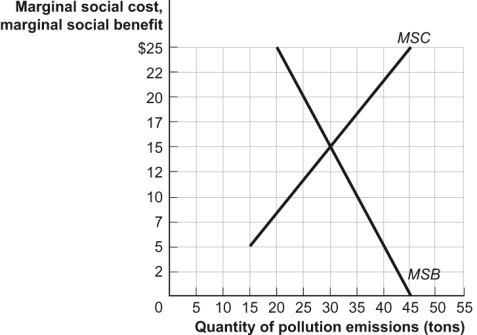

Use the following to answer question:

Figure: Efficiency and Pollution  -(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.In the absence of government intervention,the marginal social cost of pollution will equal _____,and the marginal social benefit of pollution will equal _____.

-(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.In the absence of government intervention,the marginal social cost of pollution will equal _____,and the marginal social benefit of pollution will equal _____.

A) $25;$5

B) $5;$25

C) $15;$15

D) $25;$0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Automobile emissions generate pollution,have health costs for pedestrians,and cause discomfort to residents of a city.In this case:

A) too little of society's resources are being used to operate automobiles.

B) the externality can be internalized by imposing a specific tax on drivers.

C) there is an external benefit to society from operating automobiles.

D) the externality can be internalized by granting a specific subsidy to drivers.

Correct Answer

verified

Correct Answer

verified

True/False

The total external cost of air pollution in Tennessee affects the final price of goods in Tennessee,assuming that the government does not intervene in the marketplace.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

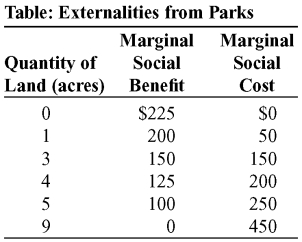

Use the following to answer question:  -(Table: Externalities from Parks) Use: Table: Externalities from Parks.The table shows the marginal social benefit and the marginal social cost of preserving various amounts of land in a city for a public park.Suppose that parks result in positive benefits to the community as a whole but that the marginal private benefit that any one individual in the community gets from parks is close to 0.If 5 acres are dedicated to the park,the park is _____ from a social perspective.

-(Table: Externalities from Parks) Use: Table: Externalities from Parks.The table shows the marginal social benefit and the marginal social cost of preserving various amounts of land in a city for a public park.Suppose that parks result in positive benefits to the community as a whole but that the marginal private benefit that any one individual in the community gets from parks is close to 0.If 5 acres are dedicated to the park,the park is _____ from a social perspective.

A) too large

B) the socially optimum size

C) too small

D) the efficient size

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Coase theorem,when negative externalities are present,a market will:

A) always reach an efficient solution.

B) reach an efficient solution if transaction costs are low and property rights are well-defined.

C) reach an efficient solution only if the government intervenes in the market with a tax.

D) reach an efficient solution only if the negative externalities are offset by positive externalities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government officials set an emissions tax too high:

A) there will be too little pollution.

B) there will be too much pollution.

C) the marginal social cost of pollution will exceed the marginal social benefit of pollution.

D) pollution will be unabated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient level of pollution is the quantity at which:

A) its total benefits exceed its total costs to society by the greatest possible amount.

B) its total benefits to society equal its total costs to society.

C) the marginal social benefit of an additional unit of pollution is greater than the marginal social cost of the additional unit.

D) the marginal social benefit of an additional unit of pollution is less than the marginal social cost of the additional unit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

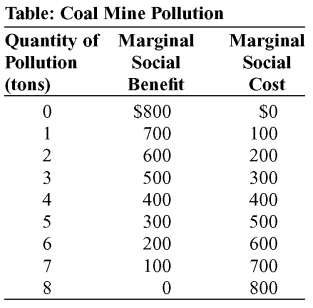

Use the following to answer question:  -(Table: Coal Mine Pollution) Use Table: Coal Mine Pollution.The table shows the marginal social benefit and cost of various amounts of pollution from a coal mine.If 5 tons of pollution is produced,the marginal social benefit is _____,and the marginal social cost is _____.

-(Table: Coal Mine Pollution) Use Table: Coal Mine Pollution.The table shows the marginal social benefit and cost of various amounts of pollution from a coal mine.If 5 tons of pollution is produced,the marginal social benefit is _____,and the marginal social cost is _____.

A) $0;$800

B) $300;$500

C) $400;$400

D) $800;$0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient rate of emissions occurs when:

A) there is absolutely no damage done to a pristine environment.

B) government forbid s all pollution,no matter what the cost.

C) the marginal social benefits of pollution exceed the marginal social costs of pollution.

D) the change in social benefits and the change in social costs from an additional unit of emissions are equal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which example illustrates an environmental policy based on tradable emission permits?

A) a charge to companies of $1 for every 100 units of pollutants emitted

B) paying companies $1 for each 10% reduction in emissions

C) allowing companies to buy and sell the right to a certain level of emissions

D) ignoring pollution and letting private markets operate without government interference

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal social benefit received from pollution is less than its marginal social cost in the market for highly polished glass.In this situation:

A) firms in the market produce the socially optimal level of pollution.

B) society's well-being cannot be improved by changing the quantity of pollution.

C) firms in the market produce too much pollution.

D) firms in the market produce too little pollution.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

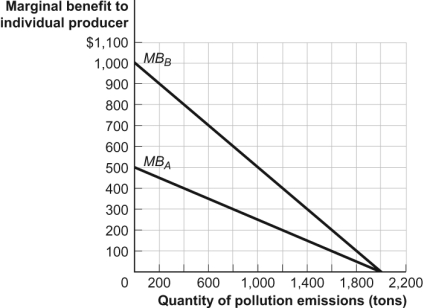

Use the following to answer question:

Figure: City with Two Polluters  -(Figure: City with Two Polluters) Use Figure: City with Two Polluters.If the government wants to limit total pollution to 2,200 tons,it could impose an emissions tax of _____ on both firms.

-(Figure: City with Two Polluters) Use Figure: City with Two Polluters.If the government wants to limit total pollution to 2,200 tons,it could impose an emissions tax of _____ on both firms.

A) $100

B) $200

C) $300

D) $400

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer question:

Figure: Efficiency and Pollution  -(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.If the government imposed an environmental standard that did NOT allow the quantity of pollution to exceed 40 tons,there would be:

-(Figure: Efficiency and Pollution) Use Figure: Efficiency and Pollution.Assume that firms are the only beneficiaries of pollution and that costs are borne solely by others in the society.If the government imposed an environmental standard that did NOT allow the quantity of pollution to exceed 40 tons,there would be:

A) a socially optimal quantity of pollution.

B) too little pollution because its marginal social benefit would exceed its marginal social cost.

C) too much pollution because its marginal social cost would exceed its marginal social benefit.

D) too much pollution because any pollution is too much from an economist's perspective.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 193

Related Exams