A) rise by $1.10.

B) rise by $1.33.

C) not rise.

D) rise by $0.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

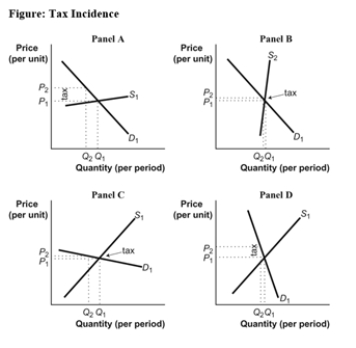

Use the following to answer question:  -(Figure: Tax Incidence) Use Figure: Tax Incidence.All other things unchanged,the effect of an excise tax on gasoline in the long run is most likely illustrated by panel _____,and the greater share of the burden of the excise tax (shown by the tax wedge in each panel) is borne by _____.

-(Figure: Tax Incidence) Use Figure: Tax Incidence.All other things unchanged,the effect of an excise tax on gasoline in the long run is most likely illustrated by panel _____,and the greater share of the burden of the excise tax (shown by the tax wedge in each panel) is borne by _____.

A) A;buyers

B) B;sellers

C) B;buyers

D) A;sellers

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax leads to a(n) _____ in consumer surplus and a(n) _____ in producer surplus.

A) increase;increase

B) increase;decrease

C) decrease;increase

D) decrease;decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that rises less than in proportion to income is described as:

A) progressive.

B) proportional.

C) regressive.

D) structural.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently,the government considered adding an excise tax on CDs that can be used to record music and CD players that can record discs.If this tax were enacted,the MOST likely effect would be:

A) that consumers would pay a higher price and producers would sell fewer of these CDs and CD players than before the tax.

B) no change in consumption or the prices paid by consumers of these CDs and CD players.

C) that consumers would pay a lower price and producers would receive a higher price for these CDs and CD players than before the tax.

D) an increase in economic activity due to the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

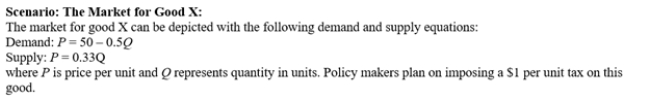

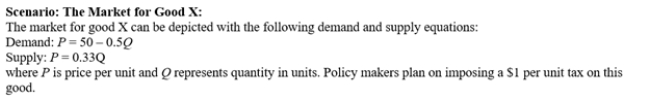

Use the following to answer question:  -(Scenario: The Market for Good X) Use Scenario: The Market for Good X.If a $1 per unit tax is imposed,the deadweight loss associated with the tax will be equal to (round all calculations to two decimal places) :

-(Scenario: The Market for Good X) Use Scenario: The Market for Good X.If a $1 per unit tax is imposed,the deadweight loss associated with the tax will be equal to (round all calculations to two decimal places) :

A) $1.00.

B) $20.00.

C) $0.50.

D) $0.60.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

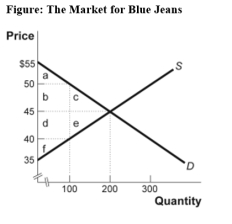

Use the following to answer question:  -(Figure: The Market for Blue Jeans) Use Figure: The Market for Blue Jeans.The government recently levied a $10 tax on the producers of blue jeans.What area or areas in the graph identify the loss of producer surplus due to the tax?

-(Figure: The Market for Blue Jeans) Use Figure: The Market for Blue Jeans.The government recently levied a $10 tax on the producers of blue jeans.What area or areas in the graph identify the loss of producer surplus due to the tax?

A) d + e

B) e

C) d

D) d + e + f

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose price elasticity of demand is relatively inelastic for good X.If the price elasticity of supply for good X is elastic and an excise tax is imposed on good X,who will bear the greater burden of the tax?

A) consumers

B) producers

C) both consumers and producers equally

D) government

Correct Answer

verified

Correct Answer

verified

True/False

To minimize deadweight loss,excise taxes should be levied on goods with inelastic demand and inelastic supply rather than goods with elastic demand and elastic supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer question:  -(Scenario: The Market for Good X) Use Scenario: The Market for Good X.If a $1 per unit tax is imposed on this good,the new supply curve will be:

-(Scenario: The Market for Good X) Use Scenario: The Market for Good X.If a $1 per unit tax is imposed on this good,the new supply curve will be:

A) P = 0.33Q + 1.

B) P = 50 - 0.5Q

C) P = 0.33Q - 1.

D) P = 0.33Q + 1 + 50 - 0.5Q.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax of $10 on an income of $100,$25 on an income of $200,and $60 on an income of $300 is:

A) progressive.

B) proportional.

C) regressive.

D) flat.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

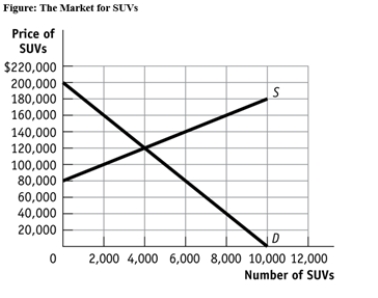

Use the following to answer question:  -(Figure: The Market for SUVs) Use Figure: The Market for SUVs.A price _____ of _____ will bring the about the same price and output in the market for SUVs as would an excise tax of $60,000.

-(Figure: The Market for SUVs) Use Figure: The Market for SUVs.A price _____ of _____ will bring the about the same price and output in the market for SUVs as would an excise tax of $60,000.

A) ceiling;$80,000

B) ceiling;$100,000

C) floor;$100,000

D) floor;$160,000

Correct Answer

verified

Correct Answer

verified

True/False

For a tax system to achieve equity,it must first achieve efficiency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax system is well designed:

A) it maximizes efficiency.

B) it maximizes fairness.

C) then efficiency can be improved only by making the system less fair.

D) it maximizes efficiency and equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

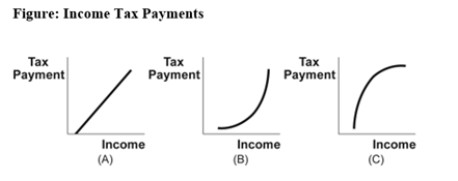

Use the following to answer question:  -(Figure: Income Tax Payments) Use Figure: Income Tax Payments.Which panel or panels BEST represent the effects of a proportional income tax?

-(Figure: Income Tax Payments) Use Figure: Income Tax Payments.Which panel or panels BEST represent the effects of a proportional income tax?

A) A

B) B

C) C

D) A and B

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the marginal tax rate is higher than the average rate,the tax system is:

A) proportional.

B) progressive.

C) constant.

D) regressive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brianna and Jess must pay an income tax.Both Brianna and Jess pay $1,000 in taxes each year,but Brianna earns $20,000 and Jess earns $10,000.From this information,you can infer that this tax is:

A) progressive.

B) regressive.

C) proportional.

D) equitable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ taxes are paid on the purchase of most consumption goods.

A) Income

B) Property

C) Sales

D) Wealth

Correct Answer

verified

Correct Answer

verified

True/False

Although employers and wage earners each pay 50% of the FICA tax,the tax reduces wages to the extent that the incidence of the tax falls almost entirely on workers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax:

A) generates tax revenue and causes deadweight loss.

B) increases consumer and producer surplus.

C) produces revenue for the government and increases total surplus.

D) is always efficient.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 286

Related Exams